Business Growth vs. Personal Wealth: What’s the Right Move for Business Owners?

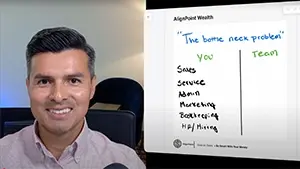

As a business owner, you’re constantly making decisions that impact both your company’s success and your personal financial future. One of the most challenging questions entrepreneurs face is business growth vs. personal wealth — which should take priority?

It’s a challenge that many entrepreneurs face, and finding the right balance can be complex. Should you reinvest every penny into growing your business, or should you start focusing on building wealth for yourself and your family? The truth is, you don’t have to choose one over the other.

In this article, we’ll dive into strategies that help you grow your business while also building personal wealth. Whether you’re just starting or have been in business for years, we’ll show you how to manage both your business and your personal finances so you can set yourself up for long-term success.

Let’s explore how to make smart decisions for both your business and your financial future.

Business Growth vs. Personal Wealth

First, let’s dive into what business growth vs. personal wealth really means. Business growth is about increasing your company’s size, revenue, and market presence. On the other hand, personal wealth refers to your individual financial security — how much money you have outside of your business and the financial freedom you achieve.

For many entrepreneurs, business growth comes first. After all, a successful business can provide a steady stream of income, opportunities, and future value. But it’s important not to overlook personal wealth. Both areas are essential for long-term success, and one shouldn’t outshine the other.

The Importance of Personal Wealth for Entrepreneurs

While your business may be your primary source of income, building personal wealth ensures that you can live comfortably, even if the business faces challenges.

Many entrepreneurs focus solely on growing their business and forget to build personal wealth through strategies like diversifying their income and creating passive income from business profits. This could lead to financial insecurity in the future.

One of the key personal wealth strategies for business owners is saving and investing wisely. This doesn’t just mean putting money into a savings account but also looking at different investment options.

Think about stocks, bonds, real estate, or other passive income opportunities that can grow your wealth while you focus on scaling your business.

Scaling a Business Sustainably: A Long-Term Approach

Scaling a business sustainably is an important part of balancing business growth and personal wealth. Rapid business growth can be exhilarating, but without careful planning, it can also lead to burnout or cash flow issues.

Instead of focusing on exponential growth, consider a more sustainable approach. Make sure you have systems in place to support growth and don’t sacrifice long-term stability for short-term gains.

When scaling your business, take the time to reinvest profits into areas that support both growth and personal wealth. Reinvesting profits wisely means you’re building a strong foundation that can help you weather economic downturns while continuing to grow your wealth.

How to Reinvest Business Profits?

Reinvesting profits is one of the most powerful ways to scale a business and grow personal wealth. Instead of taking all profits out of the business, consider allocating a portion toward expansion and investment.

For instance, you could invest in new products, marketing efforts, or talent acquisition to support the business’s long-term growth.

However, be sure to set aside some profits for your own personal wealth. Whether that’s through personal savings or investments, this ensures you’re diversifying your assets and creating long-term financial security.

Reinvesting vs. diversifying profits is an important distinction, and finding the right balance between the two is key.

Creating Passive Income from Business Profits

One effective way to grow personal wealth is by creating passive income from business profits. For instance, you could invest in real estate, stocks, or even create a product or service that generates revenue without constant oversight. Passive income helps build wealth while freeing up time to focus on your business.

A great example of creating passive income from your business profits is by investing in a business venture or other financial assets that require little day-to-day involvement but can generate steady returns over time.

By doing this, you can start to build wealth independently of the business’s active operations.

Entrepreneur Wealth Diversification Strategies

Entrepreneur wealth diversification strategies are another essential tool in achieving the right balance between business growth and personal wealth. As a business owner, it’s easy to become overly invested in your company.

However, diversification ensures you’re not putting all your financial eggs in one basket. Consider spreading your investments across various asset classes, such as real estate, stocks, or bonds, to reduce risk.

Having a mix of assets also provides multiple income streams, helping you weather any potential business downturns. Diversification strategies can be the key to achieving financial freedom for entrepreneurs.

Business Growth vs. Personal Wealth Balancing

Balancing business growth and personal wealth doesn’t need to be a tug-of-war. It’s about making deliberate decisions that benefit both areas. Set clear goals for your business while also making personal financial planning a priority.

You’ll need to take stock of where your business stands and how much personal wealth you’ve accumulated. From there, you can determine how to allocate profits in a way that supports both your business and personal goals.

One way to approach this is by setting aside a percentage of your profits for reinvestment in the business and another percentage for building your personal wealth. This ensures that both sides of your financial life are being nurtured.

Financial Planning for Small Business Owners

As a small business owner, financial planning is crucial. A well-structured financial plan helps you allocate resources effectively, save for the future, and make smart decisions for both your business and personal wealth.

Take time to create a budget for both personal and business expenses, set aside funds for taxes, and build an emergency fund for both areas. Consider working with a financial advisor who can help you strike the right balance between business growth and personal wealth.

Having professional guidance can help ensure you’re making the most of your money.

Reinvesting vs. Diversifying Profits: What’s Best for You?

There’s a debate in the business world about whether it’s better to focus on reinvesting vs. diversifying profits. Both strategies have their advantages, so it’s about finding a balance. Reinvesting profits into your business allows it to grow, which increases business value and builds personal wealth.

On the other hand, diversifying profits into other investments can help you reduce risk and build wealth outside of your business.

A mix of both approaches can be the smartest strategy. Reinvest in the business to fuel growth while also diversifying your assets to protect your finances. This balance will allow you to stay focused on the business while securing your personal wealth for the future.

Final Thoughts: Finding the Right Balance

When it comes to business growth vs. personal wealth, the key is to find the right balance. Focus on scaling your business sustainably, reinvesting profits, and building more income sources. At the same time, focus on growing your personal finances through smart investments and diversifying your assets.

By following personal wealth strategies for business owners, such as creating passive income and diversifying your financial portfolio, you can build long-term financial freedom. At the same time, continue to grow your business and scale it wisely.

In the end, the right move isn’t about choosing one over the other; it’s about finding a way to do both successfully.

Ready to find the right balance between business growth vs. personal wealth?